Mainly I recall 3 items. 1) They used primarily American mutual funds. 2) He only recommended one stock during this time: ENZN (drug stock). I moved $10k over to this single stock. It soon lost 90% of it's value (and never recovered). It currently trades at 17 cents. Not sure it even exists. 3) They charge 1.4% portfolio balance annually (this is normal). I started doing the math on the 1.4%, along with that single reco blunder, and my modest returns, and realized all this is beneficial, for them not me.

One sweltering summer day in Minneapolis, around 10 yrs ago, I was pulling into my driveway and a bloke in a suit was walking down it. We chatted. He was going door to door, introducing himself as an Ed Jones financial advisor. I was impressed with his commitment, and we had an intro chat at his office. I told him I was willing to give him a try. And I had one rule: if he ever put me onto a dog stock, I was walking. He agreed. I opened an account, a rollover from other firm.

A couple years in, he recommended a single stock: NOV (oil rig equip). Currently down 65% over the last 10 years. In fact it started tanking about a month after I bought in (also $10k worth). I think I mentioned that to him, stating how the analyst on this (the retail reps don't do the analyses) didn't see the global oil glut / price drop. They study this all day, every day, no? Welp, I reminded him of my prior rule. Told him, why not Netflix, McD, Walmart, anything stable? Anyhoots, I moved it all to Wealthfront.

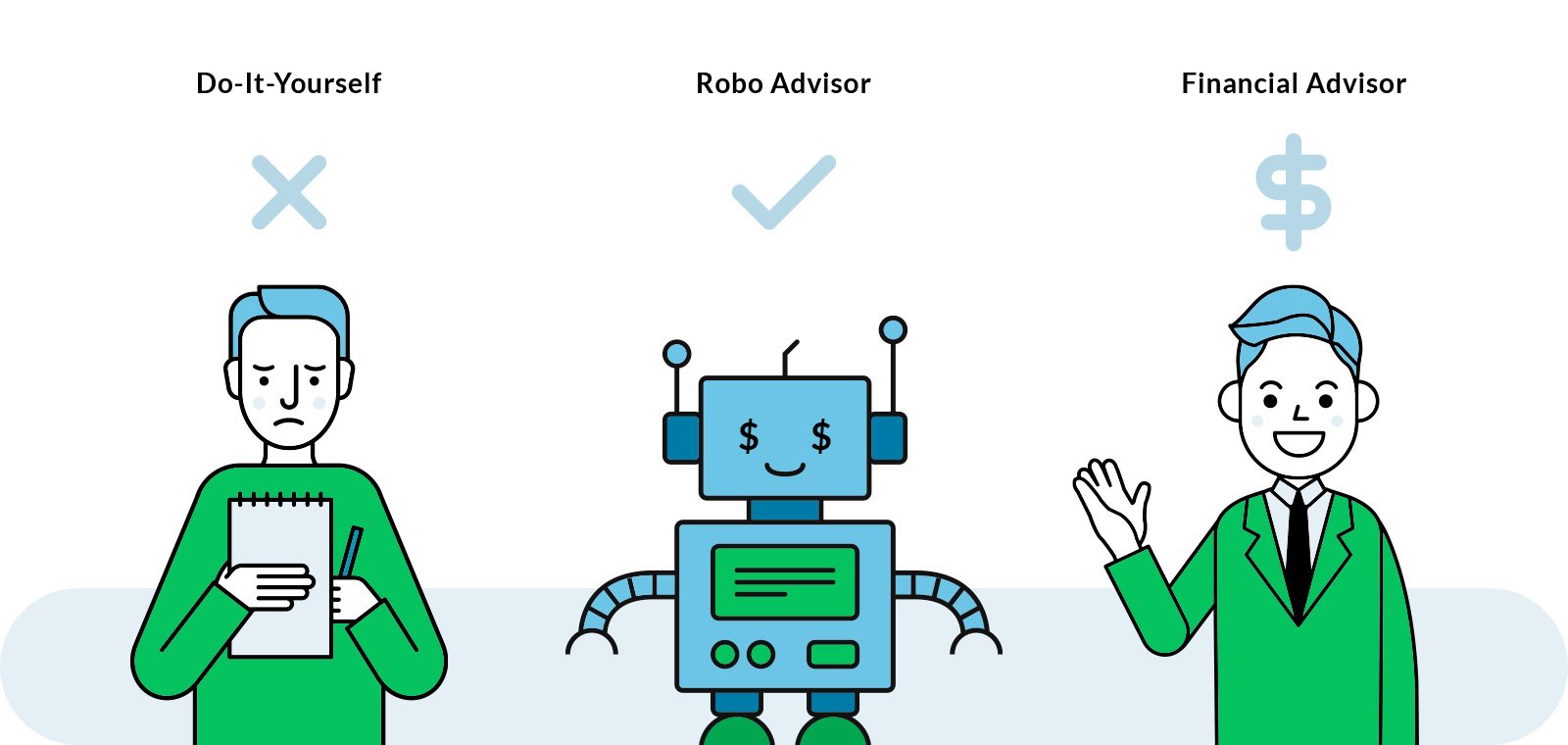

Wealthfront. Know it? They're a 'roboadvisor.' They have giant advantages.

- No humans. Pure algorithms (algos). You think your money guy is constantly re-jiggering your portfolio, daily, looking for edges for gains, and taking smart losses? They literally do nothing once you're a client, other than an annual re-balance into another boring mutual fund.

- What's a smart loss? The proper phrase is 'tax-loss harvesting.' Your money guy won't do that for you, ever. It's labor intensive (for a human). What it specifically means is trimming losses to offset your capital gains. Easy to dump the losers; not easy to dump smartly.

- Annual fee at Wealthfront is zero point two five percent or .25%. This is a profound difference.

If this reads like a paid advert, it's not. There are other robos out there, I just happen to use wf for a few years now and it's going well. I adjusted my risk level to .5, their lowest (puts ~ 70% in bonds), late last year, fortunately.